|

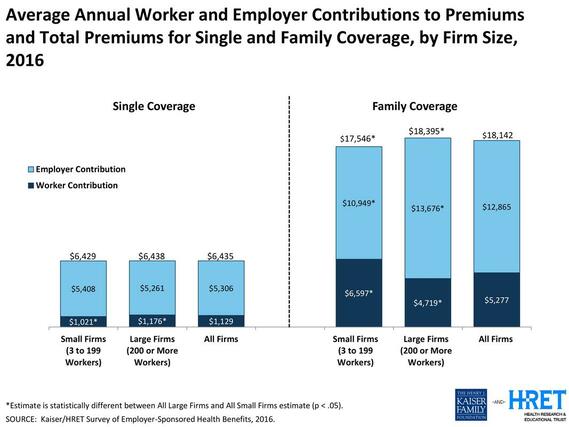

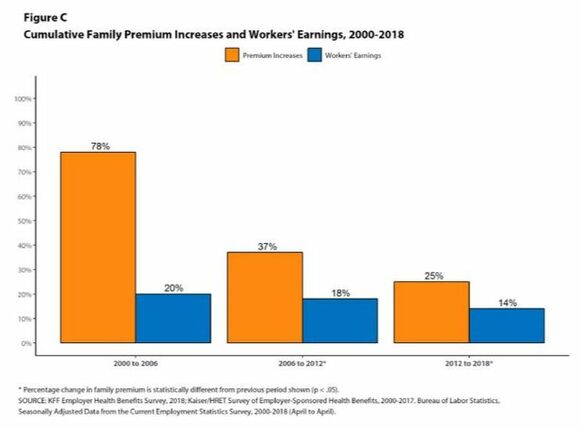

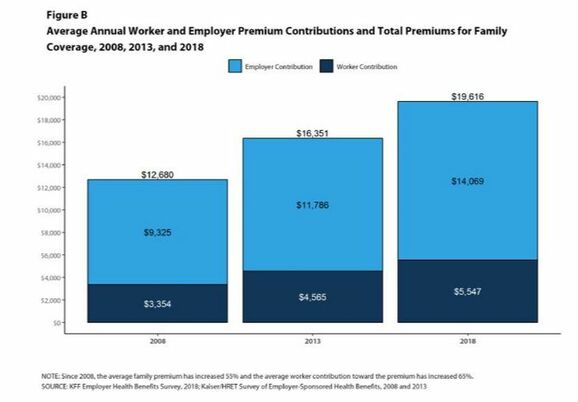

The burden placed on employees from increased health insurance cost

increased 6.5% annually between 2008-18. (source: Kaiser Family Foundation) |

US inflation rate in 2018 came in at 2.44%. Health insurance inflation outpaces inflation contributing to financial stress on the employed population in the United States.

|

National medical trend or health insurance inflation grew 5.5% annually from 2008-18.

(source: Kaiser Family Foundation). |

Why do middle market employers above 50 enrolled need ClearCaptive?

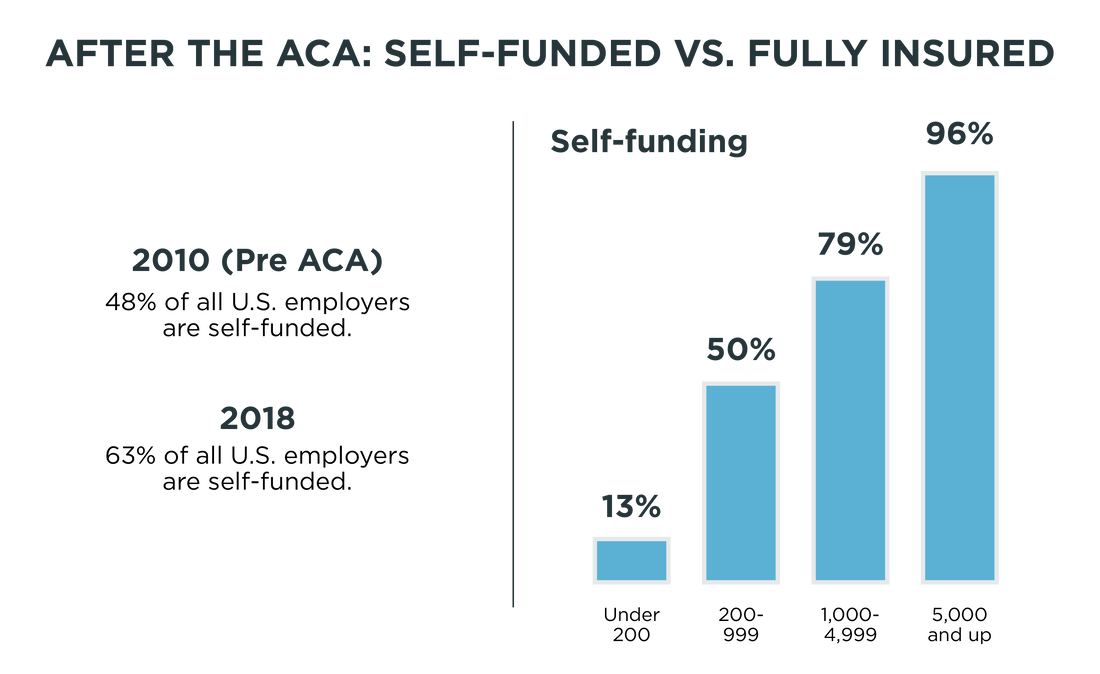

The passage of the Affordable Care Act resulted in lower medical trend for the most recent 5 years despite the significant increase in individual medical claims over $1,000,000. The fully insured market experienced a reduction of over 9 million human lives between 2011 and 2016. The lives transitioned to self-insurance, both level funded and partially self-insured.

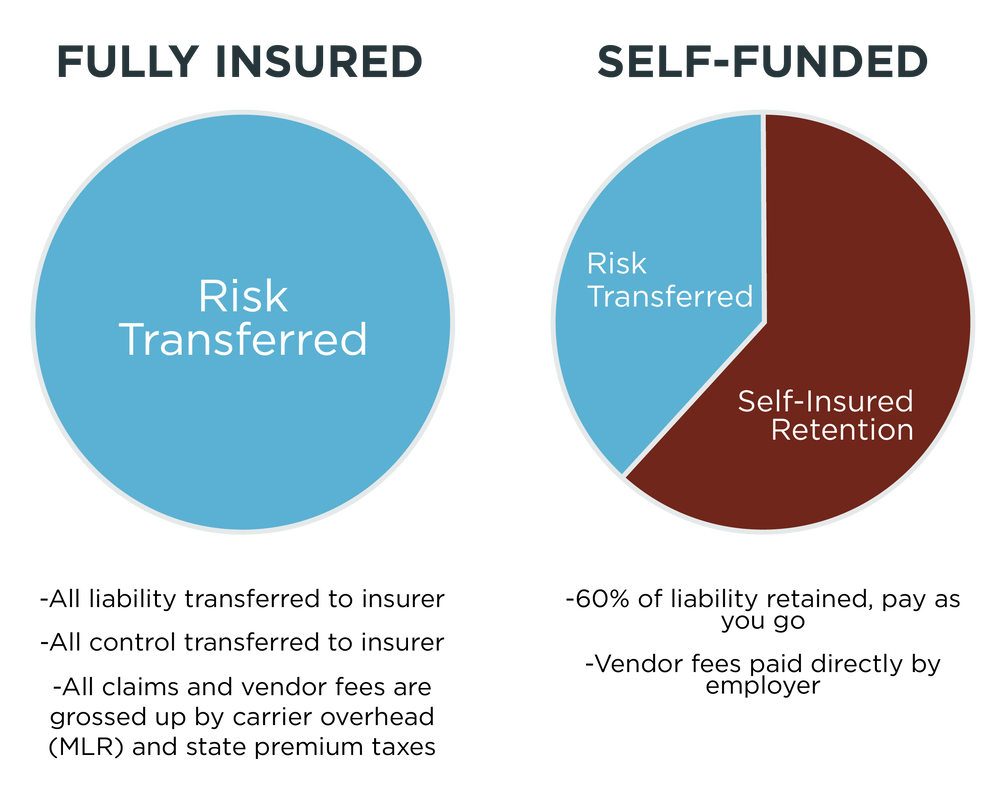

A $1.00 of premium paid to a fully insured carrier means every member medical claim dollar is grossed up by state premium taxes, carrier overhead and ACA assessments. Transitioning to partially self-funded results in 60-70% of the employer monies only paying claims cost, both RX and medical. State premium taxes (assume 2%), carrier overhead (15% Medical Loss Ratio on the low end) and ACA assessments (depends on the year) are not added to or included in claims costs paid directly by an employer through their chosen third party administrator.

The reduction of the national medical trend from 2013-2018 at 3.9% average versus 12.5% annual increase during 1999-2016 is significant. State premium taxes, removal of carrier overhead and ACA assessments on the bulk medical spend on the 9 million lives that transitioned to the self-insured market place contributed as a driving force.

A $1.00 of premium paid to a fully insured carrier means every member medical claim dollar is grossed up by state premium taxes, carrier overhead and ACA assessments. Transitioning to partially self-funded results in 60-70% of the employer monies only paying claims cost, both RX and medical. State premium taxes (assume 2%), carrier overhead (15% Medical Loss Ratio on the low end) and ACA assessments (depends on the year) are not added to or included in claims costs paid directly by an employer through their chosen third party administrator.

The reduction of the national medical trend from 2013-2018 at 3.9% average versus 12.5% annual increase during 1999-2016 is significant. State premium taxes, removal of carrier overhead and ACA assessments on the bulk medical spend on the 9 million lives that transitioned to the self-insured market place contributed as a driving force.

Direct claims are less costly as the following items are removed from the cost of the claim: carrier overhead, carrier profit, state premium taxes, Affordable Care Act (ACA) assessments.

Self-funding offers full insurance; adjusted to monthly fixed and variable costs. The percentage of fixed versus variable is based on the employers size, cash flow and appetite for directly assuming more or less claims.

Our transparent reporting makes performance measurable, ensuring renewals will be easy and include all the information necessary.

Self-funding offers full insurance; adjusted to monthly fixed and variable costs. The percentage of fixed versus variable is based on the employers size, cash flow and appetite for directly assuming more or less claims.

Our transparent reporting makes performance measurable, ensuring renewals will be easy and include all the information necessary.

|

Widely available risk mitigation and management tools utilized with ClearCaptive:

|